FWIW, people in NYC, SF, downtown LA, Seattle, etc., wished their price per square foot was $500. This is especially true if you consider the luxury and finish level that these projects promise.

That said, I am more than happy with my 15 year old condo downtown that I bought for under half that price per square foot, and for which I arguably have more amenities.

My bigger problem with some of these condo projects is some of the horrible floor plans. This is true for a lot of the new luxury rentals as well.

Not until after all the people with tons of money have been properly accommodated.

That is LA, SF, NYC priceS.

It’s really not though… new construction in NYC is usually between 2.5k and 4k per sf ($1684/sf average including older construction). San Fransisco’s average is around 1100/sf including older construction; not sure what it is for new.

I agree with you that prices are inflated by the low supply though. It’s hard to justify these kinds of places in a metro that barely even has public transportation.

$500/ft isn’t even as high as Miami prices for new construction, and the median household incomes in Miami are much, much lower than Raleigh.

Well at least you owned the land it was sitting on.

I’m not sure if Miami is really a comparable market. It’s a tourism-based economy and many buyers are foreign investors or non-residents purchasing second homes for vacationing or investment purposes. That drives up the cost of housing vs local median income. Plus, local building codes in south FL probably require additional construction expense because of hurricanes, storm surge, flooding (building in a drained wetland), etc.

Miami’s job market is tourism/service sector heavy and known for paying most workers in sunshine more than money. Hence lower median incomes.

Raleigh may be inching it’s way to a similar situation where remote workers from SF, NYC, etc. are cashing in their dumpy condos for a cool million and then buying properties in Raleigh for double what they sold for 4 years prior. Thus driving up housing costs for local income earners because the new folks are still being paid SF and NYC salaries. I’m seeing it happen in my neighborhood (incidentally, where the Lynde is located).

If you look at Miami’s new suburban housing stock in places like Doral, you’ll see that’s it’s way more expensive across the board, and in particular relative to median income levels in the county.

Point taken about concrete block construction and impact windows impact on the costs of construction in Miami, but still…

The ability for rank and file Raleigh residents to afford a home is heads and shoulders is higher than that of a typical Miami resident.

Lol. That’s one way to put it.

Miami’s highrises have a lot of imported money invested in them. This is both domestic and foreign outside money. For example, a Turkish developer is building Okan Tower. It will be Florida’s tallest tower and 70 floors. Needless to say, he’ll be pitching pre-sales to wealthy Turks, and will have the bent ear of that audience more so than any previous development. This pattern has repeated itself with other global billionaire developers. This development phenomenon is mainly a downtown/Brickell or waterfront pattern.

I am well aware of the amount of laundered and illicit money being parked there. And illicit stuff that takes place in them. This is quite the PC conversation about one of the dirtiest cities on the planet. But, yes, I agree, Miami should not be used as a comp to any other ‘market’ in the US.

Housing for the masses in Miami (not the high rises) is also more expensive. In addition to the costs associated with building to Florida’s code (windstorms), the scarcity and cost of land is high, like it is in the Bay Area, Seattle, and other geographically constrained cities/metros. My point is, its downtown aside, its housing stock is way more unaffordable to greater Miami residents, especially relative to their household incomes.

DT Raleigh’s housing is driven only by its residents’ demand. Clearly there’s a demand for this high dollar housing if people keep buying the product. Where that demand dries up, I don’t know.

Personally, I’d love to see a developer come to the council to propose a tower that’s neither ultra-luxury nor “affordable” that they intend to sell to the middle incomes (whatever that is these days), and uses the variance request to make it economically feasible. That all said, I know it’s a pipe dream and will likely never happen.

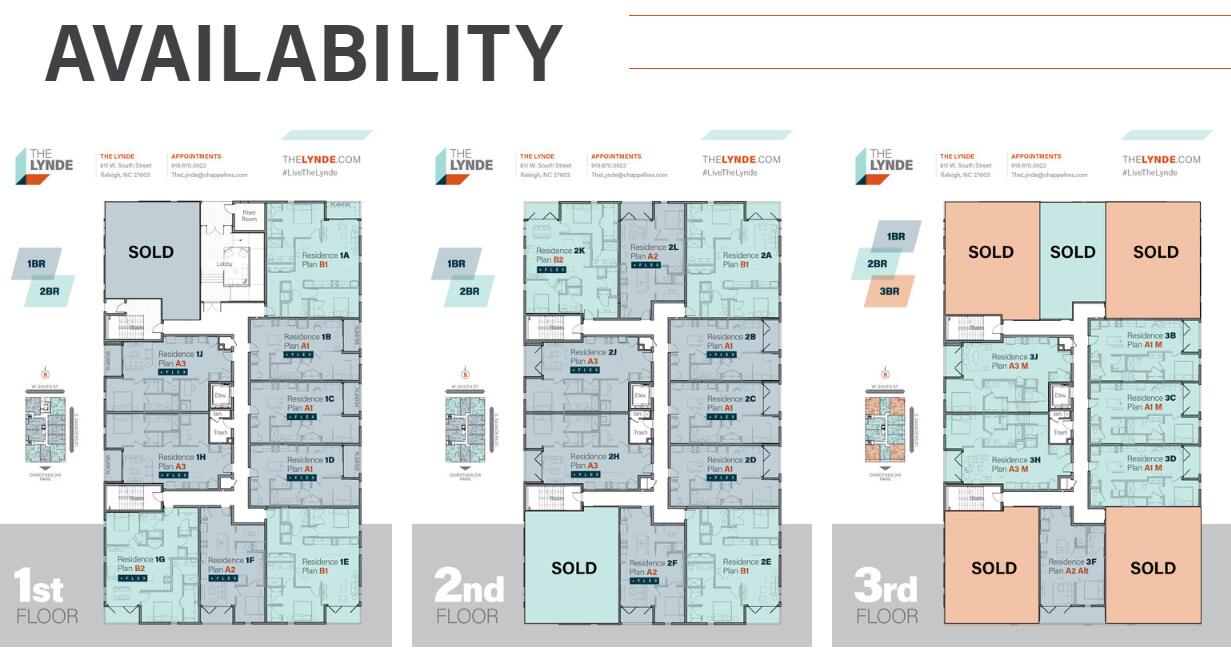

All 4 of the 3 bedrooms already sold. Wonder if they should have had more of them.

Yea interesting. I wonder if that impacts their plans for the larger building for phase 2 on the east half of the site. Weren’t they also trying to rezone the phase 2 site from 3 to 4 floors?

the 3dr are on 3rd (highest) floor, that may also had something to do with them selling first. I know I would prefer them over lower floor.

Yeah this is sorely needed. I always thought I could pull that off but I’m not an architect so don’t have all the tools laying around to fully design something. I have ideas though…

Try to telling a lender (ie: a bank) that you need $100 million…but you don’t intend to maximize your return. See how that flies.

So, there’s a way to maximize return if you make different decisions. The costs associated with all the amenities that seem to come in greater quantities with each subsequent project have to be paid for by the tenants/owners. If you eschewed these amenities for more housing space, or leased retail/office space, you still make money and you lessen the costs of the housing. Recapture all of the two story space to be more rentable/sellable space to create more to lease and sell. There has to be a model out there to provide housing that doesn’t have the highest end appliances, cabinets, finishes etc. Not everyone is looking for 12 ft. ceilings, rooftop terraces, on site gyms, or even parking.

Go see some of these “luxury” apartments and you will see they are far from having high end finishes. I lived in the Lincoln for two years and the cabinets, flooring, etc. were terrible quality. Prices are so high downtown because demand is high and supply is low. Simple as that.

Now, this could be different for condos/townhomes but I have to assume the same.

I’ve had a number of friends live in these kinds of places in the Triangle, and I have to agree. Not all of them of course, but many new units that are marketed as luxury are actually pretty cheaply built, because no matter what someone will want to live in them just due to the location, since there’s so little centrally-located housing available as compared to the demand.

These places will become the affordable units of the future when they’re a little older… IF we keep actually building units.