That’s the point of the arguments for some targeted relief or protection from value escalations. Long term, modest income, homeowners have the potential to see their values skyrocket because of what 's happening around them, even though they may have made no significant improvements to their own properties.

Incremental tax increases are not tripling yearly tax bills like the example that @ADUsSomeday states. If they were, my property tax bill would be increasing wildly, and it hasn’t.

Well that is also my point. My home value has doubled since I have bought my house. But my taxes have not even come close to doubling. County wide evaluations are revenue neutral and don’t raise taxes unless your evaluation is higher than the county average. The increase in property taxes are more likely to occur through tax increases and not evaluations. But I will concede that tax evaluations around downtown are more likely to increase above average which would result in a net tax increase.

But, don’t you live in a suburban area? Homes inside the beltline, and in these gentrifying neighborhoods, have had their values accelerate more than that norm.

I totally get that the valuations don’t necessarily increase the property taxes, because I’ve experienced that myself. However, my home is a condo that already started with a high value and its value increase was built from a higher baseline.

Homeowners in transitioning neighborhoods have seen their values quadruple in value or more, mostly because of land value and what’s going on around them. If the owners of these homes are elderly, or working poor, these new values and the resulting tax increases can be enough to drive them out.

In summary, valuation increases aren’t uniform across the city and the county, and those who own in the rapidly accelerating areas face much higher increases in their future property taxes.

Yes I do live in Cary near Bond Park. And the last two county evaluations my property value has increased dramatically and has been way above the county average, so my taxes have increased accordingly. Last tax evaluation the county lowered the land value of most townhomes (don’t ask me why) so some people got a very minor tax decrease. The tax evaluation increase would have to be pretty large with every evaluation in order to even double the taxes over a few decades. The greater Raleigh area hasn’t had those really wild upswings that they get in California, Las Vegas, etc with property values. It’s been kind of steady although it has been increasing a bit higher this past decade.

A really good example of this is 630 W Lenoir St. It’s currently vacant because the park it sits next to has flooded a few times in the last five years, but the tax valuation of the property more than doubled from 2015 to 2016 after the revaluation. The property hasn’t been improved at all, if anything it went from being livable to unlivable since then.

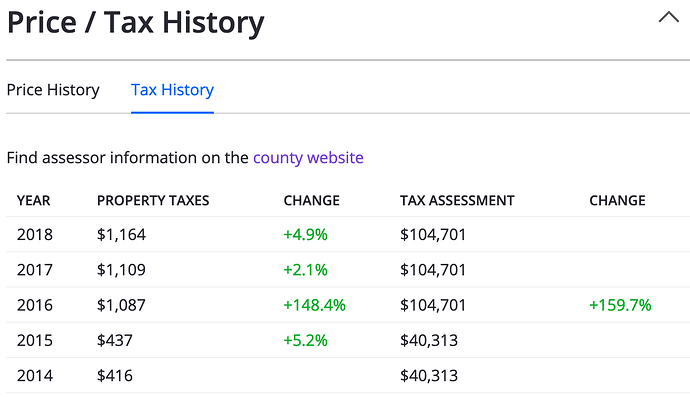

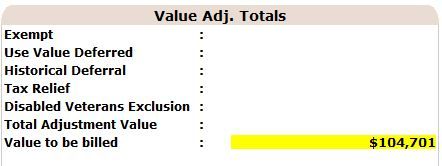

The Wake County tax site only shows the past three tax years, so I found this on Zillow for 630 W Lenoir:

I saw that it sold for $140,000 last year and it was only valued at $40,000 4 years ago. You can go to Fuquay Varina or Wendell (etc…) and buy yourself a nice house with a bigger lot for that kind of money.

True, but you probably can’t walk to much of anything from the house in Fuquay, Wendell, etc. and then you’re spending a good chunk of your free time to maintain the lot (or money to pay someone else to do it). And you have less free time because your commute is longer and you’re spending more time in a car for almost everything.

The Lenoir St property is valuable for different reasons (walkability, proxmity to jobs, healthcare, entertainment, greenways, transit, etc). I live near it and am lucky to put at most 5k miles on my car each year. If I had been living in this area for many years and was on a fixed income, I’d have to make big tradeoffs to live in the farther flung areas just because the properties around me are gentrifying.

Different strokes and all. Thankfully these different options exist, but people on fixed incomes who have been in their homes for a long time sometimes find themselves having to involuntarily to give up their way of life due to the changes. I’m sure people who enjoy living outside urban areas wouldn’t want to have to make the opposite types of tradeoffs if the situation was reversed.

Many people are always making choices to move from their homes for any number of reasons. The opposite of what you say is also equally true. I would have to make big tradeoffs to live anywhere near downtown Raleigh and I wouldn’t want what you have and enjoy. I personally think I have the best of both worlds as I work downtown and get to enjoy the big city (haha) Monday through Friday during working hours, and then I get to live in my suburban neighborhood with a bigger yard, more trees, peace and quiet, and greenways and a big park basically next door. I understand gentrification is an issue but it’s the very success of downtown Raleigh that causes it.

I think that the point that’s (perhaps) being missed here is that we are talking specifically about displacement of existing homeowners who do not have means. When a property is sold or significantly improved to a much higher value, I presume that the purchaser has both the means to make that happen and pay higher tax rates. Those are not the owners that we are concerned about protecting.

All some of us are saying is that long term residents of highly limited means should not be financially punished, or forcibly pushed out of their homes, because those with money/means have decided to gentrify around them.

I wonder if there are not already ways to help these people?

There seems to be a number of ways to get your taxes adjusted, although I don’t know how it works or how much you can get your taxes lowered. Does anybody had any knowledge on this?

@John I think thats exactly the point. I have neighbors that are in their 70s and 80s that were literally born in the homes they still live in. They have made no improvements but their home values have gone up dramatically as in @Deb’s example. I don’t think they should be forced out of their homes because of a tax bill that increased by four in just a few years. There should be a way to work with this. Maybe something like the homestead exemption that was described.

Maybe eventually a real plan might emerge???

Perhaps, instead of playing a passive-aggressive game of “forcing” developers to put affordable units in increasingly luxury and amenity rich buildings in exchange for zoning variances, the city can incentivize developers to build less luxurious housing in exchange for zoning variances? Why do all apartment buildings need extensive amenities, 10 foot ceilings, high-end kitchens and baths, etc? If a tower is filled with units that are built more affordably, and isn’t laden with expensive amenities to build and maintain, wouldn’t that result in more affordable prices? Now, I’m sure that someone will say that developers can’t afford to build to a lower price point because of costs of land, but wouldn’t allowing them more floors of housing address that issue by making the land costs per unit lower? Developers could also provide basic amenities a la carte like parking spaces, storage units, and gym subscriptions. This way, a renter isn’t paying for what they don’t need or want.

What do folks think about the idea that upzoning parts of the city “gives away” our leverage or power to incentivize developers to provide things that the community needs? Councilor Stephenson has said this before that the UDO upzoning parts of downtown was a mistake. The thinking is that if a developer wants more height, we can exchange the permission to go higher if they provide something the city needs such as affordable housing but it could also apply to other things.

I think this sounds good on the surface but I struggle to be 100% convinced this is a viable strategy. Using affordable housing as an example, I almost would prefer for the city to take the lead, be the owner/manager, whatever, on that affordable housing because the city is mission-based, community-based rather than driven by numbers. (private developers)

One perspective I take, using Smoky Hollow phase 3, is that any additional height should be seen as a bonus and somehow, the added revenue because of that needs to go to community needs. SmoHo3 was zoned for 12-stories, we should agree that, generally, we are fine with 12-stories here. If we get 12, well that’s fine.

However, we’re going to get up to 40, so potentially 28 more floors of added space than what we were ok with. We should calculate this “bonus” of possibly 28 floors (or the actual added floor count once we have that) and then the added tax revenue of those 28 floors goes towards affordable housing, because AH is what the community is screaming for right now.

The added height, or added tax revenue, (some portion anyway) can be ALWAYS earmarked for AH going forward. If community needs in the future change, you have a revenue source to get that done.

It’s high level thinking and some number crunching would be needed but this is a tactic I think should be explored. Does anyone have any thoughts on something like this?

This is an interesting approach. I think another way to skin the same cat would be to reduce the property tax burden in the form of a tax credit based on calculated lost revenue on providing affordable units vs. market rate units.

Forcing devs to include AH units only in exchange for air-rights is going to increase the costs of other goods and services sold out of the development, whether that’s retail/office lease rates, parking rates, etc. What the city should do IMO is require a certain # of affordable units, work with the developer to calculate an honest lost revenue number into perpetuity for the discrepancy of market rate vs. AH rate, and provide a credit back to the developer/owner in the form of reduced impact fees or property tax rates into perpetuity so long as the units remain calculably affordable.

At some point the city has to pony up and budget for AH, whether that’s in the form of increased tax revenue, or reduced tax burden for AH units…

Of course, the Council has already demonstrated their lack of vision and leadership on AH with their ridiculous ADU debacle. Meanwhile in Durham, despite some loud opposition, urban residential land is being upzoned to provide opportunity for the free market to provide more housing choices.

The Expanded Housing Choices initiative passed their council earlier this month:

https://durhamnc.gov/3679/Expanding-Housing-Choices

I think the city could be a partner in many cases. There are a lot of 6 story apartment buildings being built in the greater downtown area right now. Why can’t Raleigh provide either incentives or money to developers to encourage that maybe 10% of apartment rentals goes towards affordable housing. Not a certain floor or certain units are cheaper, but potentially any of them could be for affordable housing. Partnerships are good for everybody I think. This antagonistic City Council against developers thing going on right now for political reasons seems short sighted and accomplishes little.

I definitely agree that this approach will raise prices for other things, the ground-floor retail price will probably be higher, hurting the chances of local biz setting up. The non-AH units probably go up, creating a divide.

Citizens read “affordable units”

Developers read “reduced profit per square ft.”

The result is undoubtedly higher prices